Lesson 4 – Tape Reader Setup

In this lesson, I’m going to share my “Tape only” setup. Yours doesn’t have to be like this but it will help to see what another trader uses and why.

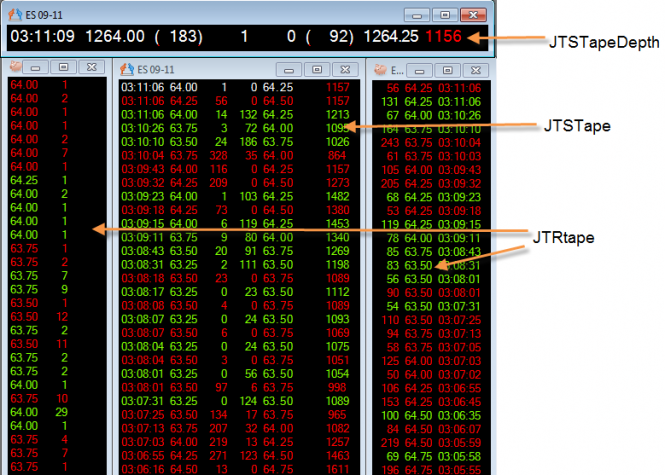

This setup is one I will use on less liquid markets such as Crude Oil, NQ, YM. It is also the setup I use for US Equities where the DOM format doesn’t work that well because of the large gaps between prices, which can make stock and futures tape reading more difficult. In this case, I am focused mostly on trade execution and not so much on depth above and below but I do still show the Depth for the inside bid/ask on the top row, which I glance at occasionally. The focus here is to do tape reading only.

Note that this is my preference only. I advocate the use of EITHER Depth & Sales OR Summary Tape for any particular market. Which one you use is entirely down to your personal preference. This is why we give a free trial so that you can start to figure out which tools suit you.

The Reconstructed Tape is always used, regardless. My main focus when Tape Reading is on the Summary Tape but I will glance at Reconstructed Tape from time to time to see which side the larger players are on. After a while, you will be able to see the Reconstructed Tape in your peripheral vision anyway. The Summary Tape is used to guage the flow of trades and who is in control, the Reconstructed Tape is used to see what side the big players are trading.

Here is a short video explaining what I have in my setup and when I’ll focus on the various parts.

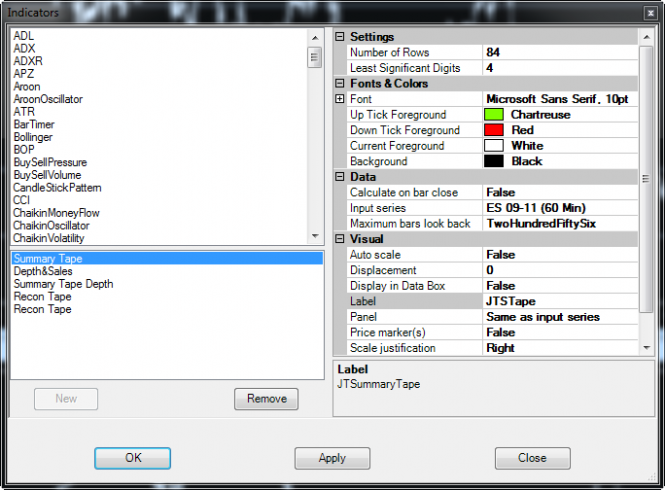

Summary Tape Settings

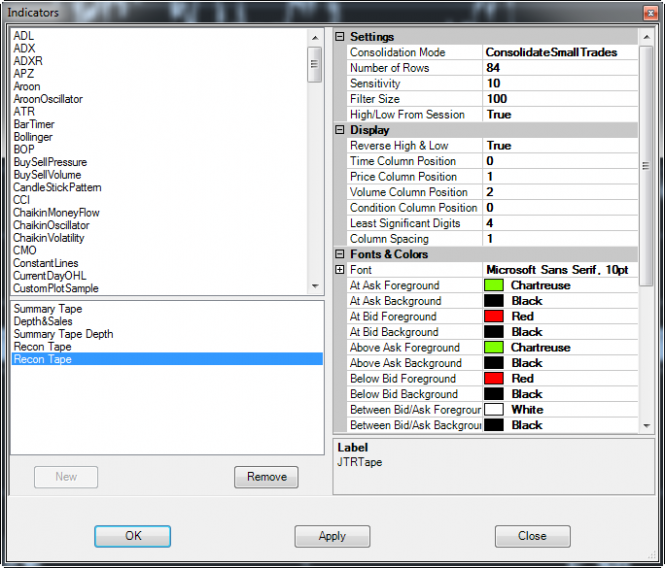

Reconstructed Tape Settings (small trades)

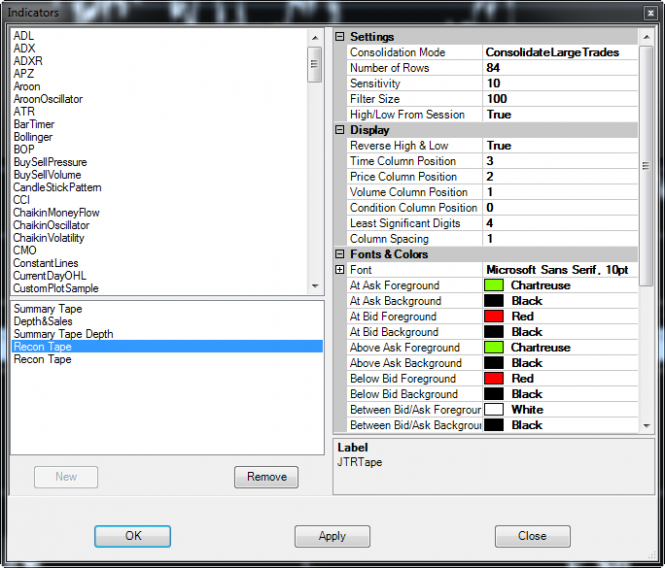

Note that small/large trades are relative. For Crude (CL), 10 contracts would be a large trade. Adjust the filter size relative to what is large for that instrument.

Reconstructed Tape Settings (Large Trades)

That’s the end of Lesson 4. Click Here to go back to the lesson plan.

Peter Davies

Copyright Jigsaw Trading © 2025

Privacy Policy

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

Jigsaw Leaderboard

Note that the Jigsaw Leaderboard contains a mixture of SIM/Live Traders. For many traders, you can click by their name to see the trades along with the SIM/Live designation.

The following is a mandatory disclaimer for SIM Trading results: