Beginning of a Range?

First – I’d like to give credit where it’s due. The person that opened my eyes to something that was right in front of them all the time was Kam Dadwhar at L2ST who, over the course of what seemed like a very long weekend laid out his method of analyzing the markets to me. Not that it wasn’t a delight to hear him speak but when you are sitting in Bangkok and listening to a guy in London do a webinar at 3am, you get through a lot of coffee.

The one thing that stuck with me the most from the sessions is how the markets form ranges and how, if you can recognize this, it becomes a lot easier to make a call on the longer term direction. What also stuck with me was how Kam finds benefit in visualizing where the market will go, what scenarios may play out. So here I am doing just that.

Now as a day trader, why would I want to have an understanding of the overall direction and where support resistance REALLY is? OK – silly question.

We’ve had a really good move up the ES and now there’s some downward momentum. Not much, just one day but a big day and therefore enough for me to start thinking about where we might be heading.

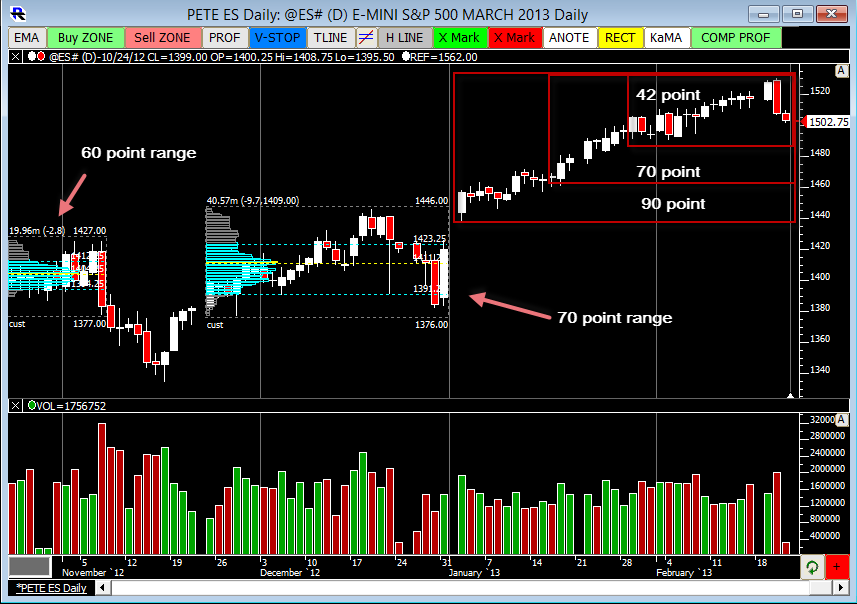

Here’s the chart as of 7:50am 21st Feb, 2013…

As you can see we previously had 60 & 70 point ranges. I’ve market out 3 potential ranges there. Three places I can see it stopping.

I suspect we’ll bottom out here at 1490 but I rather hope that is not the case. I’d like us to move down to the 1460 area and then we have a nice 70 point range that we could bounce around in for a few months.

Over time, we’ll build value in that range and look for opportunities to buy below value and sell above value.

This is my preferred scenario, starting today.

My alternate scenario, the one that I don’t really want to see is the 1500 level holding, buyers stepping in and us continuing this upward grind.

What I do not expect is for the sky to fall and for us to head into a new downtrend.

I have my scenarios. Now just wait & see what happens.

There’s some free stuff from L2ST on this page here and it is quality material.

0 Comments