Market Intelligence for Futures Traders

Professional market briefings delivered daily – before the open.

What Is Market Intelligence?

Market Intelligence is your daily briefing system – like having a research team analyze overnight moves, upcoming events, and their likely impact on your markets.

Get the same advantage institutional traders have: comprehensive market analysis, event interpretation, and clear action plans for your markets. Delivered automatically every morning in plain English.

You don’t need to:

- Spend hours researching each morning

- Understand complex economics

- Figure out how news affects your market

You get:

- Overnight moves summarized and interpreted

- Key events identified with clear guidance

- Impact assessment (bullish/bearish/neutral) for every news item

A session action plan with timing and context

Learn market relationships naturally – like watching a Netflix series where you gradually understand the characters and their behaviors. No economics degree required.

Watch the 5-minute walkthrough video

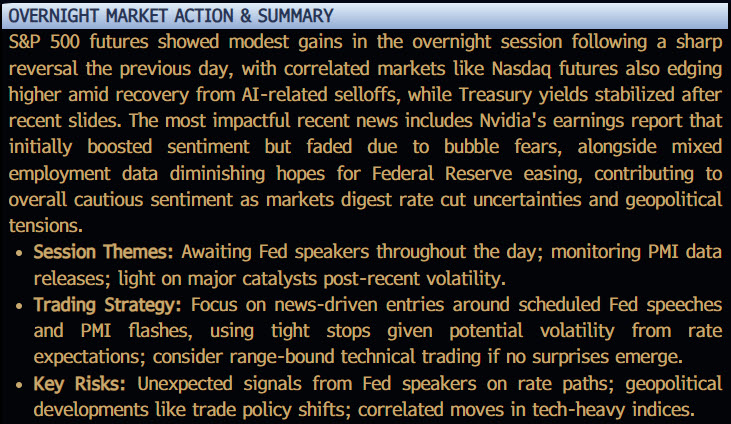

Overnight Market Action & Summary

Start your day with context. See what happened overnight in your market and correlated markets (bonds, currencies, indices). Get clear interpretation of the most impactful recent news.

What you see:

- Overnight price moves described (not just numbers – actual context)

- Session Themes: The 2-3 key drivers for today

- Trading Strategy: News-driven approach guidance

- Key Risks: What could surprise the market today

Example: “S&P futures experienced downward pressure overnight amid concerns over AI valuations ahead of key earnings reports, with correlated markets like tech-heavy indices showing similar weakness…”

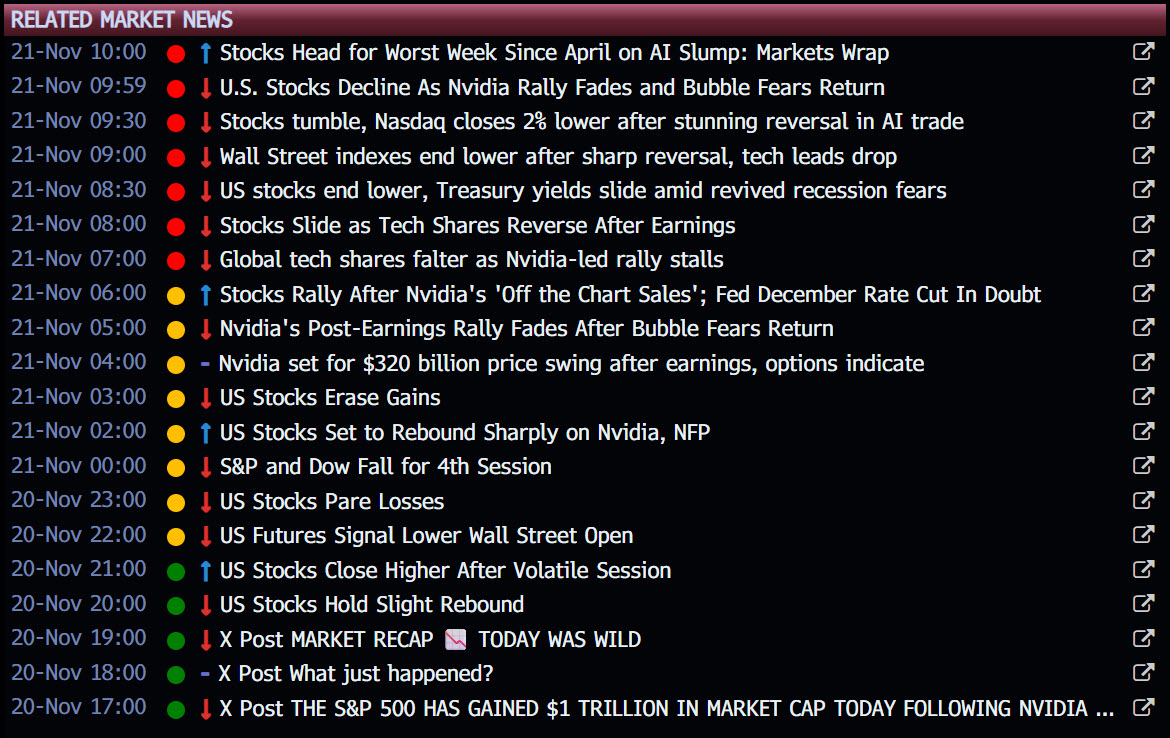

Related Market News

Every news item analyzed and interpreted for YOUR market. See at a glance whether news is bullish, bearish, or neutral – and more importantly, understand WHY.

Features:

- Red/Yellow/Green severity indicators (Red = high impact)

- Arrows show directional impact (↑ Bullish / ↓ Bearish / – Neutral)

- Clear descriptions explain why the news matters

- All times displayed in YOUR timezone

- Full article links for deeper reading

The magic: Not just “Gold moving higher on Fed Minutes” – but why that’s bullish for gold and how it typically affects the market. Every news item gets context and interpretation.

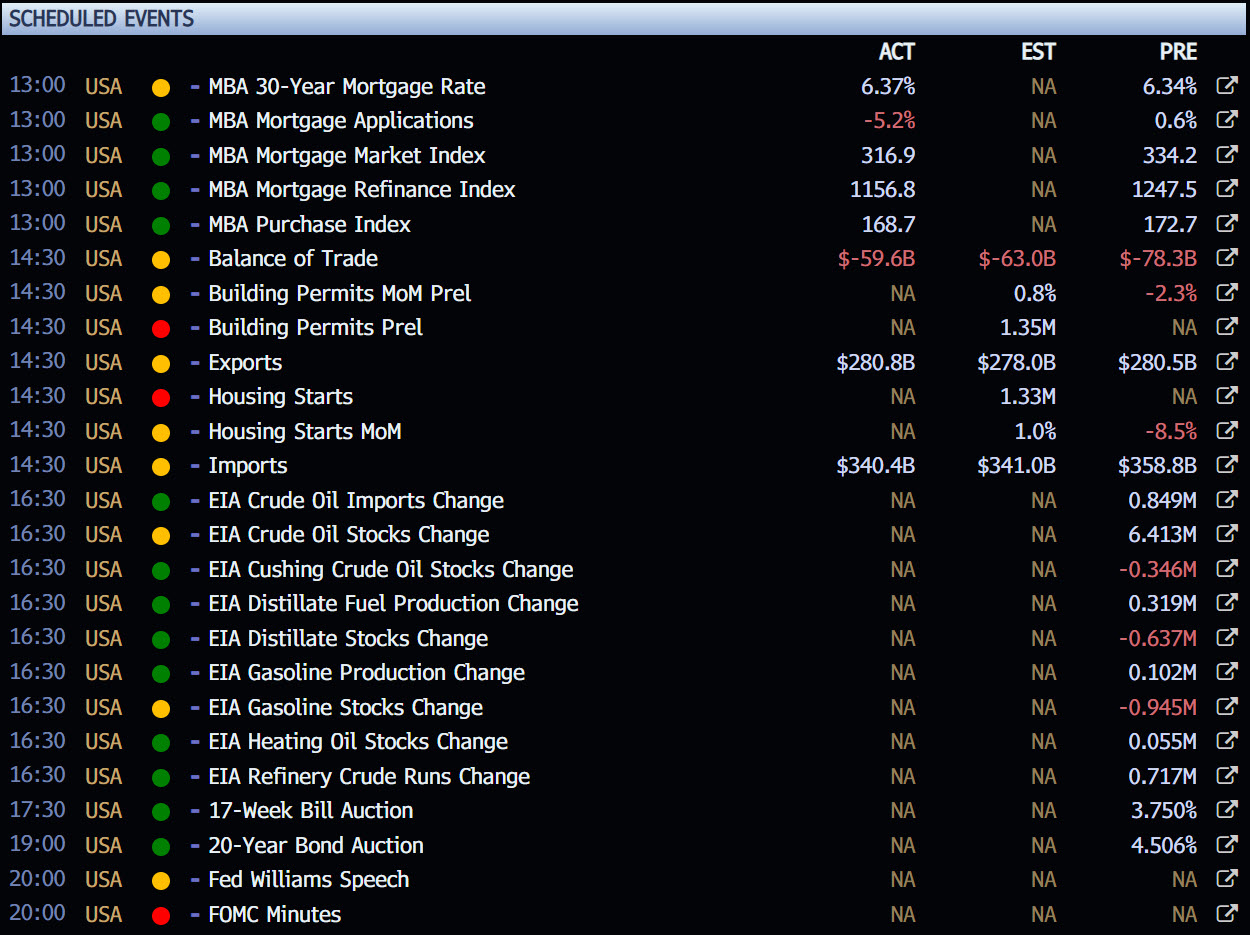

Scheduled Events

See every economic release, Fed speaker, earnings report, and geopolitical event scheduled for today that could impact your market.

What’s included:

- Event time (your timezone)

- Actual vs. Expected numbers (when released)

- Previous reading for comparison

- Guidance: How beats/misses typically affect your market

- Impact arrows when events complete (↑ Bullish / ↓ Bearish)

Example Guidance: “Higher-than-expected result is positive for S&P 500 because it signals stronger economic growth supporting corporate earnings. Lower-than-expected result is negative because it suggests slowdown concerns.”

No jargon. No “hawkish” or “dovish.” Just clear explanations in plain English.

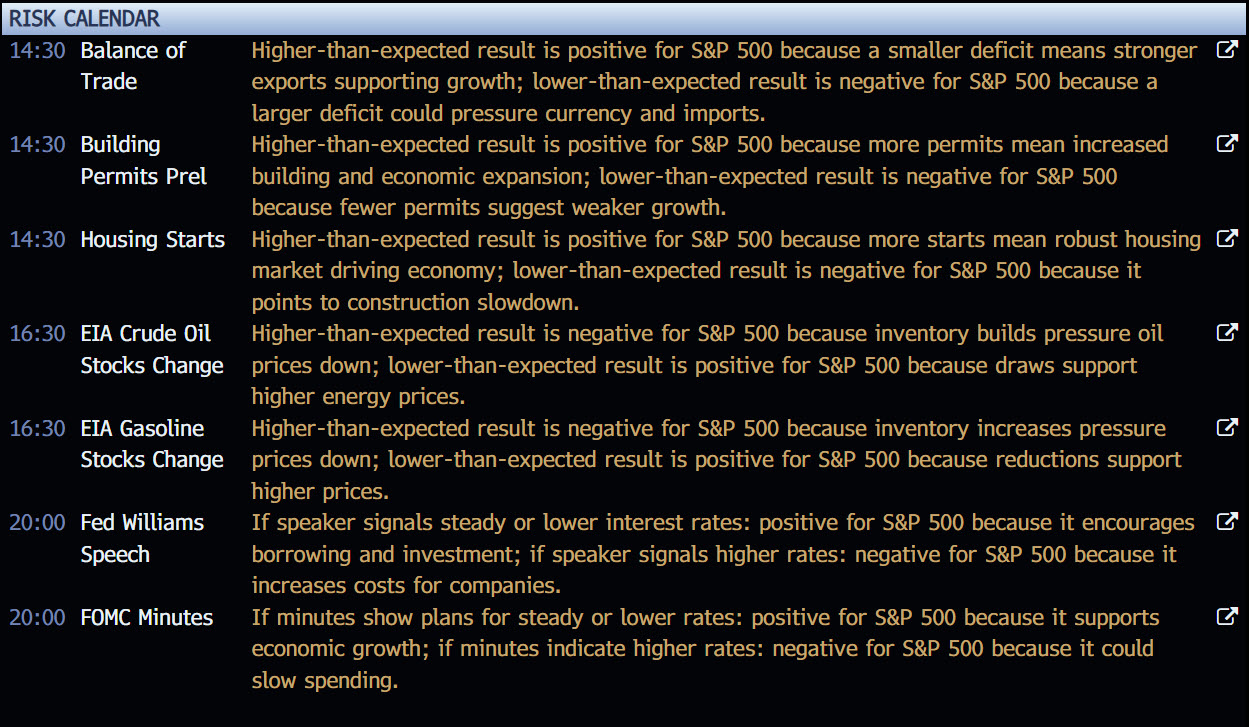

Risk Calendar

Your timeline for the trading session. See when key events hit and what to watch for – filtered to only show events relevant to YOUR market.

What you get:

- Chronological event sequence

- Clear timing for each catalyst

- Impact guidance specific to your instrument

- Direct links to full event details

The difference: Corn traders see grain-relevant events. ES traders see macro data and Fed speakers. Each Risk Calendar is customized – not a generic economic calendar.

Print it out. Keep it on your screen. Trade with context all day.

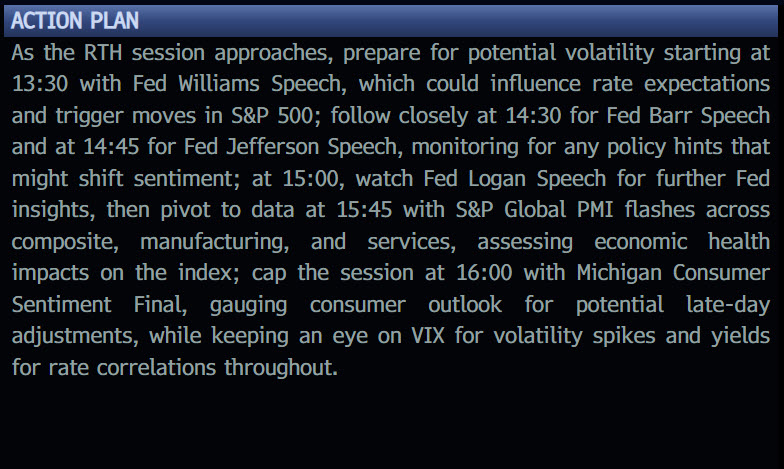

Action Plan

Your blow-by-blow guide for the session. What’s coming, when it’s coming, and what to watch for.

Example: “With the session underway, focus shifts to key events. At 19-Nov 14:00 UTC, monitor Fed Williams Speech for signals on interest rates. At 19-Nov 18:00 UTC, Monthly Budget Statement could influence fiscal outlook. Align trades around these times with stops to manage surprises.”

This is your research team’s session brief – delivered automatically every morning.

Key Levels & Flows

Get yesterday’s and today’s price data at a glance, plus institutional flow analysis.

Key Levels:

- Current day OHLC

- Previous day comparison

- Percentage changes

Flows:

- COT (Commitment of Traders) positioning

- ETF inflows/outflows

- Institutional patterns over past 2 weeks

- Overall sentiment assessment

Longer-term context to complement your intraday trading decisions.

Access Market Intelligence

Market Intelligence is included with:

- daytradr Core 4Life ($579 lifetime) – Yesterday’s prep for all markets

- Market Intelligence ($50/month. $500/year) – Today’s prep delivered before the open

- Journalytix Monthly/Annual Subscription – Today’s prep delivered before the open

Markets Covered (more coming)

- S&P500 Futures (ES)

- NASDAQ 100 Futures (NQ)

- Gold Futures (GC)

- Crude Oil Futures (CL)

- Corn Futures (ZC)

- 10 Year Treasury Futures (ZN)

- Euro Currency Futures (6E)

Access from:

- daytradr platform (chart toolbar or separate window)

- Journalytix dashboard (coming soon)

- Direct web link (coming soon)

Important: This is interpreted information based on typical market reactions. Markets don’t always react the same way. Use this intelligence to inform your decisions, not replace your analysis. You don’t have to trade differently – but this context can keep you out of trouble and help you understand what’s driving your markets.

DISCLAIMER: This analysis is for educational purposes only and does not constitute financial advice. Market reactions described represent typical historical patterns but actual outcomes may vary significantly. Trading involves substantial risk of loss. Always conduct your own research and consult a financial advisor before making trading decisions.

COPYRIGHT & USAGE: © 2025 Jigsaw Trading. All rights reserved. Sharing or redistributing current Pre Market Prep reports is prohibited without a licensing agreement. Historical reports may be shared for educational purposes with attribution to Jigsaw Trading.

Copyright Jigsaw Trading © 2025

Privacy Policy

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

Jigsaw Leaderboard

Note that the Jigsaw Leaderboard contains a mixture of SIM/Live Traders. For many traders, you can click by their name to see the trades along with the SIM/Live designation.

The following is a mandatory disclaimer for SIM Trading results: