Understanding Jigsaw daytradr Connectivity & US Futures Data Fees

Update: CME Reached out to us, asking us to make a correction to this article:

“I am reaching out in regards to this post around non-professional data fees. There seems to be some confusion around a communication that our customer, Rithmic, shared and how that relates to CME Group’s data licensing policies. While it is true that fee adjustments for non-professional data came into effect on April 1, our reporting policy for non-professional use has not changed and this criteria has been in place since 2014. Rithmic was communicating changes to their customers necessary to remain compliant with their current licensing agreement. There are no broad policy changes coming on May 1.

To help avoid any additional confusion in the marketplace, we are requesting that you update your blog content to correct and clarify. Please let me know of any questions.“

We did reply asking for a minor clarification but didn’t get a response yet. We will follow up as that comes in.

Our understanding right now is that this is not so much a rule change but resolving a discrepancy between how CME and Rithmic interpreted the rules. Rithmic have been asked to report instances of 3 or more simultaneous connections to a Rithmic account by a single user. These instances will be counted as professional users after May 1st.

In other words, changes appear to be specific to Rithmic connections and Rithmic have provided a work-around for those that use more than 2 platforms.

We don’t believe that other providers are being asked to make any changes at this point.

Updated Original Post.

If you have more than 2 connections to a specific feed, you will be considered a professional trader (and pay professional fees).

With daytradr, you can use data from one account to trade many accounts. That helps save on required data connections. You can, for example use CQG data to trade both your CQG and Interactive Brokers accounts.

Jigsaw daytradr allows you to connect directly to a data feed (e.g. CQG, Rithmic, GAIN) or to 3rd party software via the Bridge (NinjaTrader 8, MT5). There’s also some ‘middle ground’ such as Interactive Brokers and IQFeed where we also connect to 3rd party software but where that might not be obvious to the user.

This is where another rule from the CME comes in.

If you connect directly to the data feed from an application, that counts as one connection. If application A connects to the data feed, and application B connects to application A to share the data, this only counts as 1 connection. Only application A is connecting to the data feed.

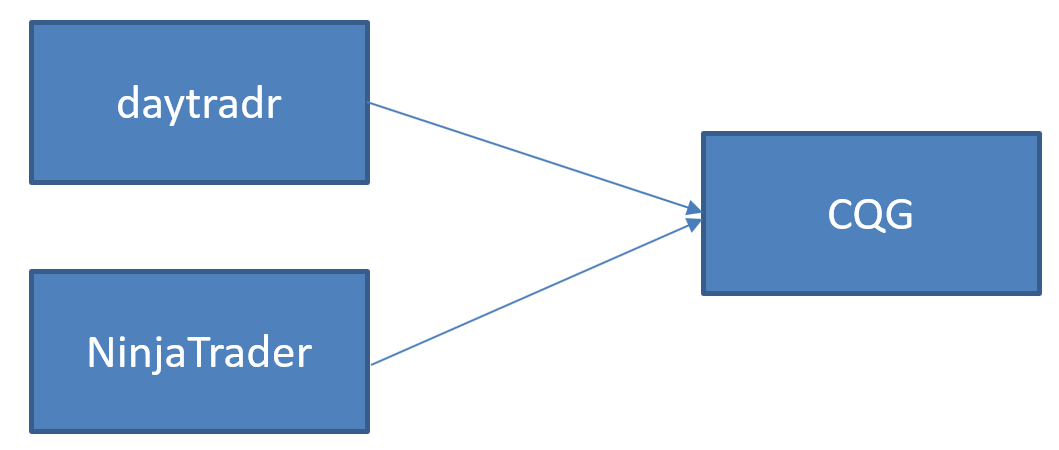

Consider the following scenario:

In this case, we have both daytradr and NinjaTrader connecting to CGQ Continuum. In both NinjaTrader and daytradr you would have set up a connection to CQG Continuum and would need to connect in order to use the data. This section of the daytradr manual covers the setup of a connection to CQG.

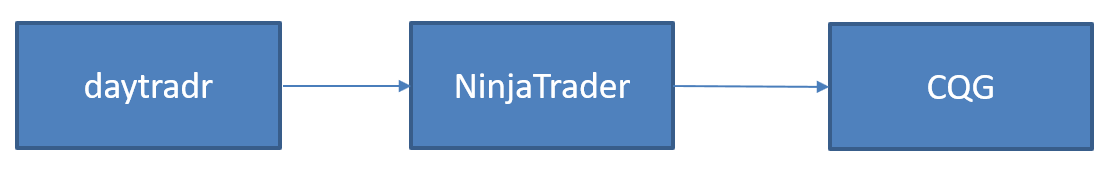

You can also connect like this:

This approach uses the daytradr bridge. In that case, daytradr connects directly to NinjaTrader and “pulls” the data from NinjaTrader. The daytradr platform does not connect directly to CQG, so this does not count as a second connection. We call this type of connection a “bridge”. This section of the daytradr manual covers the bridge to NT8.

We have bridges to both NinjaTrader 8 and MT5. There are 3 other cases where we connect to other software and where it should not count as an additional connection (but might not be obvious to the user):

- Connecting to IQFeed

- Connecting to Interactive Brokers TWS

- Connecting to Rithmic R Trader (new)

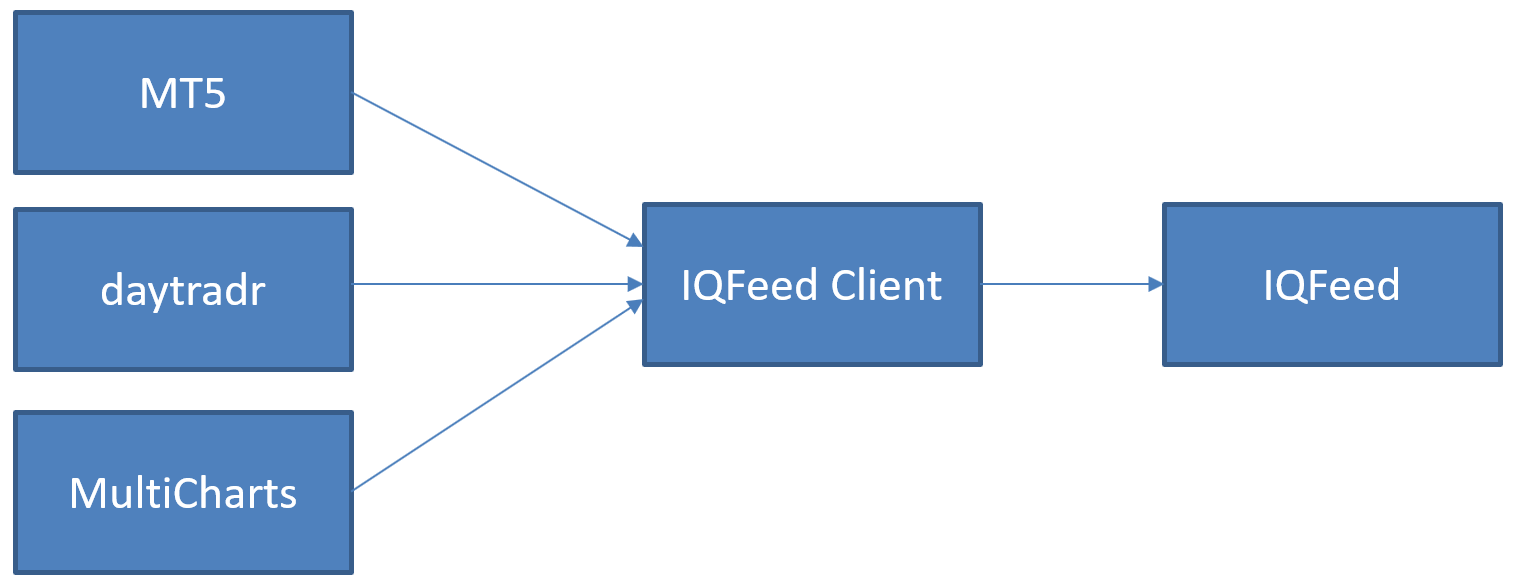

IQFeed

Many of our customers use IQFeed data feed. In this case, users install the IQFeed client on the PC and the platforms connect to that:

In this case, the 3 platforms on the left would not count as 3 connections. They all connect to IQFeed Client and IQFeed Client connects to the data service, that counts as 1 connection.

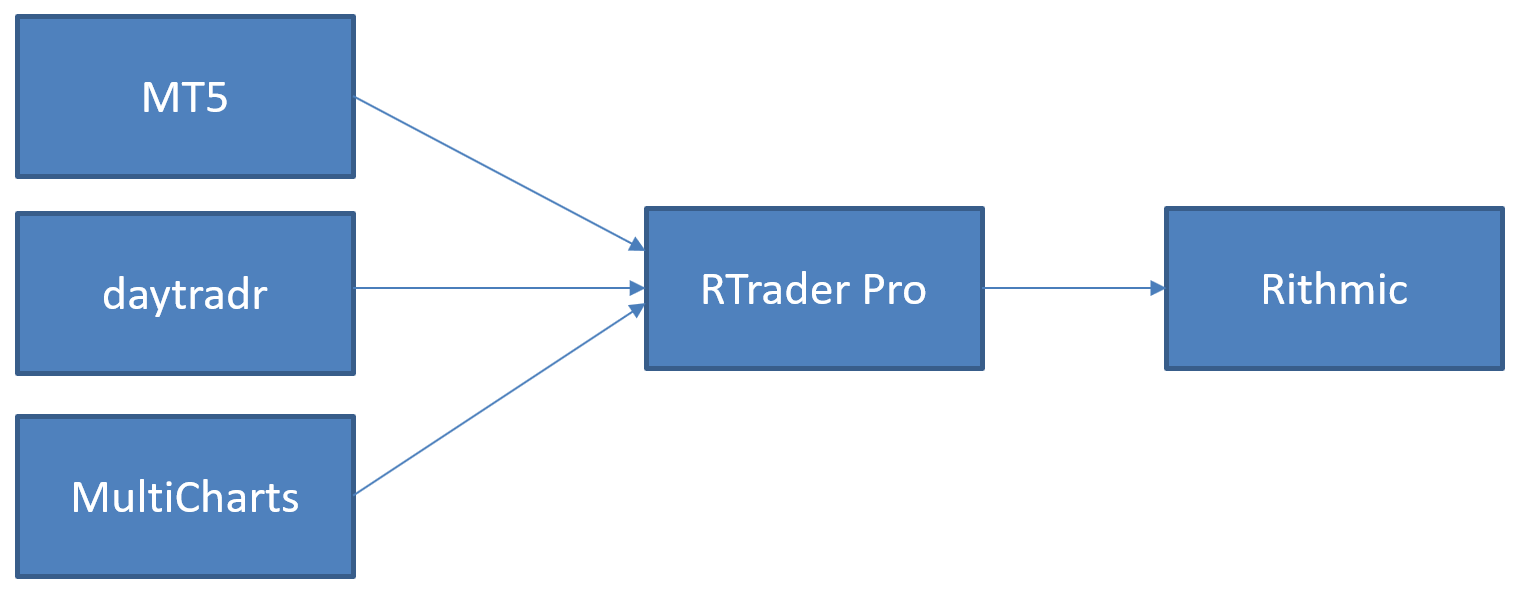

Rithmic RTrader Pro

Rithmic are introducing a new connectivity option to help counter the fees. We have already made the necessary changes in daytradr and will release something before 1st May that allows you to do the following:

Instead of connecting each trading app to Rithmic, they connect to Rithmic’s RTrader Pro . It’s like a bridge. (Note that the above diagram is just an example, do not take it as a statement that MT5 and MultiCharts have made the changes their side to connect to RTrader Pro). You start up RTrader Pro, connect each platform to it and this only counts as having 1 connection.

Connections that do NOT count as an additional concurrent connection to the CME

- Interactive Brokers TWS

- IQFeed

- MT5 Bridge (note MT5 for futures is free at AMP & some Brazilian brokerages)

- NinjaTrader 8 Bridge

- Rithmic Via RTrader Pro

If you only connect 1 platform at a time to a feed, it’s not something you need to worry about. You can connect to 1 platform, close it and then connect to another platform and it won’t count as 2 concurrent sessions.

If you connect to 2 platforms at a time to a feed, you may pay data fees for both. Currently that is $30 for all 4 CME exchanges. So $60 per month in CME fees.

If you connect to 3 platforms at a time to a feed, you will pay professional data fees for all 3. If you are subscribed to all 4 CME exchanges, that would be $105 per exchange. That’s $420 per connection or a total of $1,260 per month. It’s difficult to understand the logic behind these changes, no home trader is going to pay that.

Realistically, counting concurrency can only be done per account, so if you have an accounts 3 different brokers, it’s hard to see how CME will know you connected to all 3 at the same time. Same if you (not that it’s allowed) opened an account in your partners’s name.

The end result is that the industry will react to this new state of play. In some cases like Rithmic by offering alternate solutions that end up reducing the fees. People that now pay for 2 connections will go with a solution that allows them to pay for 1. Most likely reducing the total fees collected by CME.

FREE BONUS: Take a look into the decision-making process of professional traders with this video training series that helps you make smarter trading decisions.

0 Comments