Day Trading Rule #4 – Choosing Your (Trading) Religion

Schrödinger’s cat: A thought experiment where a cat in a box is both alive and dead until observed, illustrating quantum superposition’s bizarre implications.

Schrödinger’s hamster: A dumb mistake where you put a cat in a box of hamsters, where we know how the hamsters will end up.

Some things just don’t go together. Like petrol in an electric car.

I got into trading because some dodgy financial advisors lost 30% of my net worth in a year. I figured that “If I’m going to lose money, it’ll be cheaper to do it myself – at least I’ll save on fees!”.

My intentions were to invest in companies long-term. Then swing trading. Then day trading. For me, the shorter the trade duration, the better for my nerves.

You need a guiding philosophy or framework or belief set for your trading. I went through three of them until I settled on day trading.

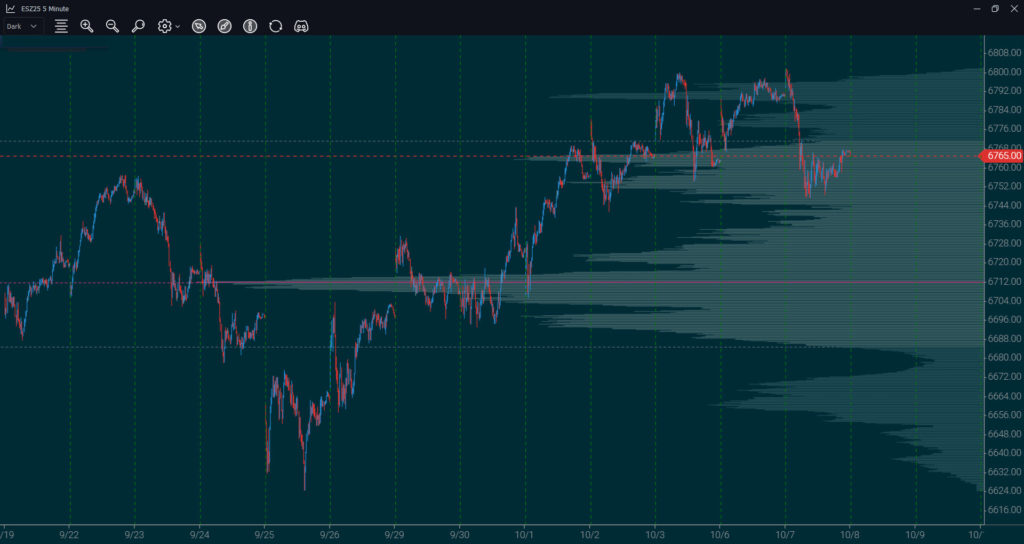

Within day trading, I prefer to go with the momentum of established intraday trends.

I have various ways to see if a market has reversed or not (which I’ll share in a later lesson). In February 2020 as COVID was hitting, a tool called “Cumulative Delta” stopped being of use in identifying the difference between a pullback and a reversal. I dropped it and kept the two remaining.

If you invest in Mutual Funds or watch financial TV, you’ll often hear them talk about the 200 day moving average (average end-of-day price for the past 200 days) as well as the 50-day moving average. If I was investing, I might pay attention to it, but as a day trader, those long-term lines feel as irrelevant as humans to ants, scuttling in their micro-world, blind to the giant boot looming on a scale they can’t even fathom.

If you trade the S&P 500 Futures, aka “The ES” (the 500 largest US companies), then news in the smallest company in the S&P 500 is unlikely to impact you, but news in Apple or Google might.

Your belief system will contain a number of components. My favorites:

You have to be able to explain in detail why something is valid. Like, behavior that can occur when you return to an area where people lost money recently.

Long-term volume profiles (a histogram of the volume at each price for the past months/years) are based on the theory that a market has memory and that people do the same thing months later at the same prices. It would be a rare individual whose memory was that good, and there has never been a day where I thought “oooh – I traded that price 57 days ago”

The more people see something, the more likely there will be a reaction there. It takes size to turn a market, which implies more, not less people. So “secret levels” are the least likely to work in my worldview.

Trends continue because people continue placing big orders. At the top and bottom of the market there’s usually very few trades. At any time, the market is more likely to continue what it’s doing, than to stop and do the opposite.

Multi-timeframe analysis, as most do it, is unrealistic. People scan daily, hourly, 30-min, 15-min, and 1-min charts, saying, “trade when they all align.” But the S&P 500 often delivers 4+ tradeable swings each direction daily, and at least half WILL NOT match the daily, hourly, or 30-min trends. I like the bigger picture, but with just one chart that gets closed when the market opens.

There’s no “they” in the market—nobody’s controlling it. Statements like “they’re trying to take it to 6,500” are invalid, for a few reasons: If you wanted to push a market up 20 points, you could buy a ton of contracts. But then selling them would shove it right back down by the same amount.

To me, the market is a collection of people trying to guess what the collection of people will do. You are as much a part of the market as anyone else. You are the market, the market is you.

“Don’t trade the news” is common advice. The markets DO get volatile as news sparks the biggest moves. News traders know that certain types of news generally impact markets in a certain way, enough times to make it profitable.

Similarly, time of day advice like “don’t trade the first 15 minutes”, “don’t trade overnight” and “don’t trade at lunchtime”. One trade I designed gave you setups as early as 7 seconds after the open:

I don’t trade overnight or at lunchtime, as I’ve never really been attracted to it.

My point with the last two items is that during these times, there’s plenty of trading going on, by people who figured out how to benefit from it.

As you learn, you will find some things easier, you’ll find something more fun and you’ll find many cool things other people do that don’t fit with your approach.

So call it a philosophy, a religion, an approach – and put a box around it. Anything that doesn’t fit with the other things in the box should be thrown away. It may be great – but not for your approach. You may just end up reinventing your philosophy over and over again. Partly because whenever anyone tells you how they trade, they rarely tell you how much hair they lost over it.

Bonus

Here’s something to look out for, if you also trade individual stocks. This is one I still like. From my long term trading period.

When bad news comes out about a company their shares slide. Often this is an over-reaction. One such case is a product recall. For instance, let’s say Ford had to recall Mustangs and F150’s because of brake issues. Their share prices would drop that day. When that happens – you can go and look at their financials if they have:

- Low debt

- Good interest rates on their debt

- Good cash flow

- A good amount of cash

- Are profitable

Then it makes trading the product recall a less risky trade. Recalls are regular on cars, motorbikes, food products, baby powder, etc. Just keep an eye on the news.

FREE BONUS: Take a look into the decision-making process of professional traders with this video training series that helps you make smarter trading decisions.

0 Comments