Day Trading Rule #5 – I did it my way

You will trade like nobody else. You’ll end up trading in your own unique way.

Scary, eh?

It is, until you realize it’s to your advantage and that it’s inevitable. You should embrace it, not fight it. It’s the way most things work, although we often don’t see it that way.

Surveillance cameras can identify people by the way they walk. According to my wife, me, my daughter and our sausage dog all wiggle our butts when we walk. Yet, who thinks they “walk differently”?

Most of you learnt to drive. Formula 1 Champion Max Verstappen doesn’t drive the same way I do.

The tools play a part too. A fast car changes your driving. You can overtake more frequently. You can lose control more easily..

We don’t all drive the same – yet we all learnt the same.

There’s 2 components to how you trade. One is reading the market and one is taking advantage of what you see. If you taught 2 traders the same technique and then watched them for a year – would you expect them both to enter and exit at the same time.

There’s so many things that are unique to you that impact your trading.

- What you enjoy, yet doesn’t derail.

- What you were taught & believed.

- How much confirmation you feel comfortable with.

- The things you observed.

- The things you find easier.

- How much money is in your account.

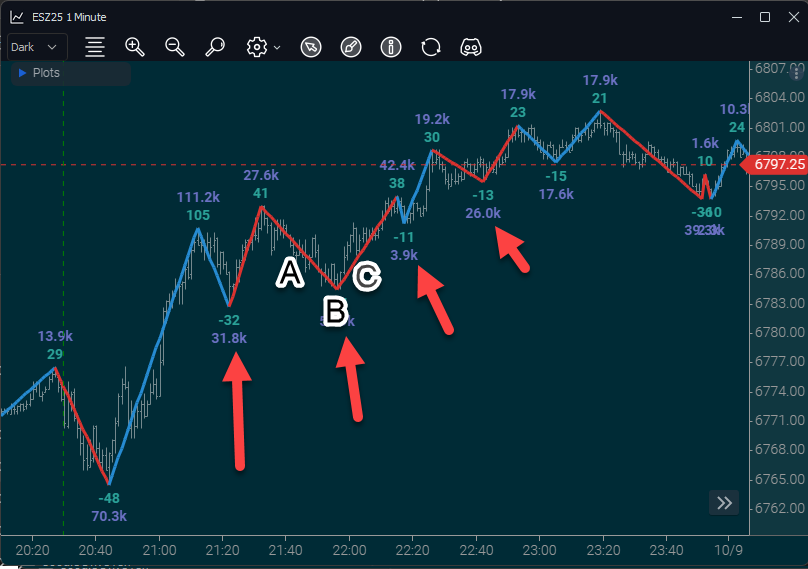

Take a simple pullback in a trend.

You may have been taught how to identify a pullback. How and when you trade it will be based on how well you can identify the late stages.

A. Aggressive early entry.

B. Trying to nail the end of the pullback (possible sometimes).

C. Wait for the pullback to happen and then get in.

This is all about how well you can get a read on the market and your appetite for risk. My preference is point C most of the time and occasionally point B.

Over time, you might find that pullbacks are good but that:

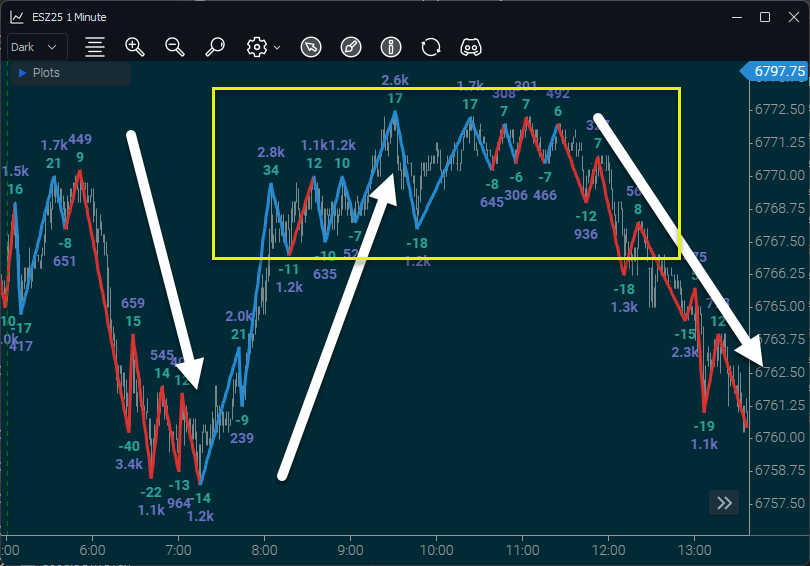

- Early in the day, swings work better than late in the day.

- That trading pullbacks in the yellow box don’t work so well as it’s a choppy area where there was no decisive direction, so you might wait until you get below the yellow box.

You might also decide that you will trade pullbacks in the direction of the trend, no matter how far that trend has gone.

This is just one example of an understandable trade, so you understand that you will adopt and then adapt naturally.

What you can’t do – is trading “free for all”. Many novice traders attempt to trade on the basis of “I think the market is trying to do X and I will do Y” – and every day “X” is a totally different thing. There is no consistency in approach.

You do need to learn or be taught how the market moves. You can’t just switch on the screen and jump in.

You have to remember Trading Rule #4 too – you have to stay in your trading lane and keep it simple.

My trading ‘how’ clicked at Singapore’s Financial District networking events (Harry’s Boat Quay), where traders were shocked I stayed awake for their market talk—more on learning later.

Get the knowledge, and by all means, follow someone else’s path. Just know that their path and yours will naturally diverge at some point and that’s how it’s supposed to be.

It may surprise you that there is no Tradebert Einstein hidden in a secret lab creating trading setups. You will discover your own. It’s something that will occur as naturally as me scratching the rims on my wife’s car.

Just let it happen.

FREE BONUS: Take a look into the decision-making process of professional traders with this video training series that helps you make smarter trading decisions.

We love your take on learning and the Jigsaw DayTrader.

My advice, focus on something and learn it inside out, but keep it simple, dont keep tweaking it with more indictors, listen to others for ideas that relate to your specialty, not theirs, lots of good ideas but most dont help your path. And remember, it is just price and volume.