Day Trading Rule #7 – Everybody Wants to Trade the World

Trading “the world” sounds daunting, until you grasp the vast universe of events that can move a market. Then the world shrinks to a speck. In trading lingo, “the world” is just charts; the “universe” is whatever sparks real reactions.

I have a bit of a reputation for being anti-chart. So much so, that I’ve had sessions with people where they apologize for using charts. Charts are absolutely a part of the picture, but not the biggest part by any means.

If you cast your mind back to trading rule #3 “what is trading edge”, we defined it as:

“Seeing something occur that moves the market in time to take advantage of it.”

I don’t like to use the word “setup” anymore, it makes people think of charts. I prefer to think of the Universe of opportunities as “Events”.

Events are what moves the market. Your job as a trader is to understand an event well enough that you can take advantage of it. As events can essentially be anything and as there’s a universe of them, it’s easier to explain by example.

People that day trade equities, tend to focus on quarterly earnings reports, analyst upgrades/downgrades, news (good and bad) such as a new CEO, a product recall, a new deal. The trader I know that had the most success with this had 3 full-time researchers feeding him opportunities.

Mostly it was focused around earnings:

- Does this company typically underestimate earnings and then beat them?

- How does the stock tend to respond to a big hit or miss on earnings?

During earnings seasons, they’d use sites like briefing.com to present him with the “hot” opportunities like “AAPL beat earnings in their announcement this morning, they are up on the pre-market but historically, they tend to give back those gains at the open”

- The event: AAPL beat earnings again.

- Expectation: AAPL will fall at the open after a pre-market bounce.

The Play? Interestingly, as unique as this event is – the “job” of the trader – is EXACTLY the same for this type of event as any other type of event:

- Figure out if what’s expected is really happening (is it going down, is there a lot of participation.

- Get in.

- Get out.

The trader would rely on order flow and intraday charts (but often no chart was used) to figure out how much participation there was and whether it was dying out.

Now, if this sounds a lot like momentum trading (aka following short term trends), you’d be absolutely right. It is simply jumping on a move and the better you are, the earlier you can do it.

This is momentum trading, but the key here is that the trader is looking for specific events to trigger momentum.

A more “technical” event is a pullback trade. I would never personally buy support or sell resistance BUT, if I see a market move up from an area of support, I’ll think “that’s more likely to be a short term reversal”.

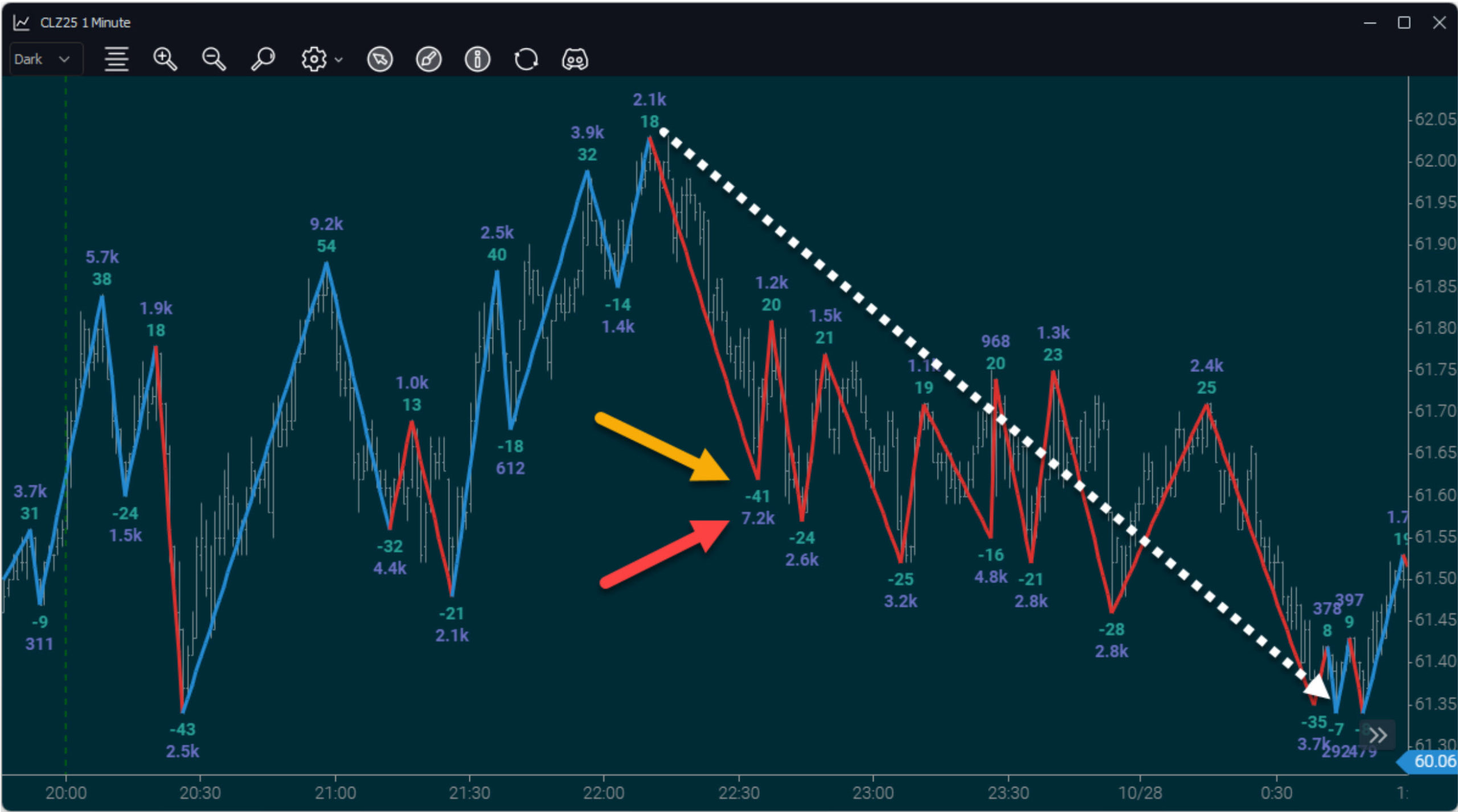

I’ll also look at the sizes of the swings. As above, you can see the -41 (size of the move) and 7.2k (volume in the move) are large compared to other moves, especially to the downside. So the “reversal” event consists of:

- A move off a well observed level (support/resistance, overnight high/low, today’s high/low).

- A large swing in the new direction with an excessive amount of volume relative to the day.

That event is used to set bias, so after that swing down with the red/yellow arrows, I would then look for a pullback – which should be a smaller low volume swing. I have a number of ways to tell if the pullback has ended (Most Effective Day Trading Strategies and Order Flow Setups) and then, I become a momentum trader.

See? Whether ‘fundamental’ like earnings or ‘technical’ like reversals, it’s all events sparking momentum, your execution stays the same

And one issue that traders have is they only want to look at “technical” setups because that fundamental stuff is “way too hard”.

The problem with that, is that the technical events work in the absence of the fundamental/news events. In other words, if you are eyeing up a moving average crossover while Donald Trump is making a speech about Tariffs on China, then Trump trumps your technical setup.

Of course, you can argue (and I agree), that news can initiate a move, and then you can jump on the momentum based on a technical setup – even if you don’t know what the news is. This is true, but if the news is a Donald Trump speech, and he’s still talking, the market could very easily spin around and move the other way.

One way or another, you need to have situational awareness of the events that move your market, even if you won’t trade it.

There’s a whole universe of events out there. A few years ago, a Saudi Oil refinery got hit by a missile, oil prices went up. Then about a week later, there was a one-off meeting scheduled where a Saudi Prince would update us on how long it would take to get back online. Many traders (including myself), were waiting for the announcement – but then somebody leaked it a couple of hours before the meeting, the news was great, limited damage, and they’d be online in weeks. People like me were blind sided and missed the move. Tough luck – but the thing is, as the news played out, there was plenty of action to play off.

You could say that event was “a potential reduction in oil supply” and you could call the leak “a potential increase in oil supply”. Oil Inventories on a Wednesday also often fit one of those definitions – sometimes there’s a lot more or a lot less than expected. Sometimes the market reacts and sometimes it doesn’t. Sometimes there’s momentum to trade and sometimes there isn’t.

And you know what, you could take that oil news and trade different markets. You might trade the S&P500 Futures and go long if oil prices go down. For more on that, take a look at our “idiots guide to market relationships” (https://www.jigsawtrading.com/blog/idiots-guide-to-market-relationships/)

We can’t cover every type of event here, but just to give you an idea of the breadth.

- Weather: Early freezes hammer grain markets by risking crops.

- Scheduled: FOMC, jobs data, oil inventories – all predictable punches.

- Long-running: Elections, trade wars – markets flip with polls

- Unpredictable: Terrorist attacks, rate shifts, etc. etc.

Of course, traders are often dismayed at this because the allure of technical analysis is “it’s all in the chart” and “I only have to learn 1 thing”.

If only that were true.

Trading is tough. There’s a variety of things to learn, and “what makes this market move” is one of the most important. Even if you don’t trade those events, and you want to stay “100% technical” – you still need to stay out of the way of the events.

But once you identify the event and have an expectation of the reaction to the event, the way you trade the event is very similar for all markets. You are either going to wait for the reaction and join it (momentum trading) or you’ll anticipate the end of the old move (reversal trading).

So, learning new events isn’t reinventing your wheel, it’s just filling your basket with more triggers for the momentum or reversals you already play. Charts are key, but events light the fire.

FREE BONUS: Take a look into the decision-making process of professional traders with this video training series that helps you make smarter trading decisions.

Do you have only 7 rules?

More coming soon!