Lesson 1 – The Basics of Order Flow

Buyers & Sellers

One of the most common misconceptions about the markets is that markets move up because there are more buyers than sellers and that markets move down because there are more sellers than buyers. Normally, I would say this is nonsense, for today, I’ll be nice and settle on saying it’s impossible. The markets are a mechanism for matching buyers and sellers, that is what they do, they bring buyers and sellers together. If you are a buyer and there is nobody selling, then you will not be buying anything. You can’t buy fruit if no-one is selling it and you sure can’t buy contracts if there’s no seller either.

If this is news to you, then of course you are wondering what makes price move. If every buyer has a seller, then why does price move at all? First, lets make sure we understand what the price is.

At any time, for any instrument, there are two prices. Many web sites and trading platforms show you the price of a share/contract. In most cases, this would be the last traded price. This is the price the last share/contract was traded at. Still, this is not ‘the price’ because there are actually two prices. To understand this, we’d better first make sure we understand what a limit order is.

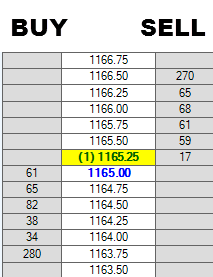

This is a picture of the Depth Of Market (or DOM) for the S&P e-mini futures contract (the ES). In this picture, we can see limit orders to buy on the left and limit orders to sell on the right. Buy limit orders are called “Bids” and Sell Limit orders are called “Asks” or “Offers”. A list of prices is in the center. We can see that the highest bid is 1165.00 and that there are 61 contracts bid at that price. The lowest offer is for 1165.25 and there are 17 contracts offered there. We can see that there are bidders and sellers at various prices.

It is no surprise that buyers want to pay a low price and sellers want to sell at a higher price. Think about when you buy a house, you have in mind a maximum price you want to pay. The owner has a minimum price they want to sell for. If your maximum price is lower than the sellers minimum price, then one of you (or both of you) have to change your price otherwise you wont be doing a deal.

These numbers we see on the DOM are limit orders, these are orders placed by people who want a price and are willing to wait for the market to come to them before trading. If price doesn’t come to their level, then they wont trade. This is a bit like the seller of the house refusing to drop his price. In the picture above, we have buyers wanting to buy at 1165 and sellers willing to sell at 1165.25, no trades are going to be made if something doesn’t change. If the seller of a house doesn’t drop his price, then you have a choice, you (or someone else) can meet that price or the house doesn’t get sold. This is the same in the markets. If you want to ‘meet the price’, then you put in a market order.

A market order to buy (above) would see you buying from the seller at 1165.25. A market order to sell would see you selling to the buyer at 1165. In this case, you have ‘hit the bid’ (sold) or ‘hit the offer’ (bought). You aren’t willing to wait for price to come to you and you are willing to transact at a slightly worse price to get into (or out of) the market. The market order is considered more ‘aggressive’ than the limit order. The limit order is an order at a price and you will only trade at this price, the market order is accepting a slightly worse price to enter the market.

In the above picture, we can see that there are 17 contracts ad 1165.25. If someone puts in a market buy order to buy 20 contracts, what will happen? First of all, he’ll get all 17 contracts at 1165.25, Then he’ll get 3 contracts at the next price up, 1165.50. At this point, the best selling price or best offer is now 1166.50.

See what happened? The amount of buyers and sellers were equal and the price went up.

I did say earlier that there were two prices. There are always two prices in the market, the inside bid (the highest bid price) and the inside ask (the lowest ask/offer price). In the above picture we can see the inside bid is 1165 and the inside ask is 1165.25. If all of the bids are consumed by seller market orders, price will move down. If all of the offers are consumed by buyer market orders, price will go up. This is the basis on which we analyze order flow.

In Summary

At any time we have two prices and these prices are limit orders to buy and sell. No trades are made unless somebody ‘hits’ one of these prices with a market order. This process of hitting the limit orders will reduce the number of limit orders at a level. The people with the limit orders often pull them out of the way. This could be because they never intended to trade in the first place or that they want to move aside because they think better prices can be had later. The process of these limit orders being hit and pulled is what causes the markets to move up and down. Whilst every buyer has a seller, there can be buying pressure and selling pressure when the limit orders on one side are being traded away with people placing market orders.

Time & Sales AKA The Tape

Now we understand price, market orders and limit orders, we can make sense of the Tape.

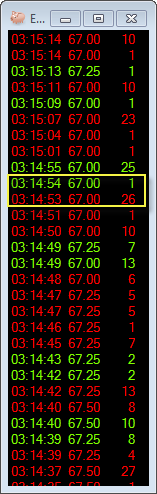

This is the Reconstructed Tape and it has the same format as most Time & Sales. This display shows every trade that occurs in the market. The top 2 rows show trades at 67.00, these lines are red. This means the trades occurred at the Inside Bid. They are red because a Sell Market order hit the inside bid. There IS a buyer and seller for these trades but the person who initiated the transactions was a seller so it’s considered bearish. The third, green row at 67.25 represents a buyer initiating a trade which hits the inside ask, so it’s considered bullish..

When we look at Time & Sales, we might think that the only information we can get is a list of trades. If we look above at the two trades in the yellow box, we can see at 3:14:53, we have a red print, 26 contracts at 67.00. The next print at 3:14:54 is a green print for 1 contract at 67.00. What this tells us is that the price has ticked down. On the first red print, the inside bid was 67.00 and inside ask was 67.25. For the next green print to be at 67.00, price needs to have ticked down to 66.75 bid and 67.00 offer. There is a lot of information you can get from the Tape alone which you will discover if you decide to take up Tape Reading seriously.

That’s the end of Lesson 1. Click Here to go back to the lesson plan.

Peter Davies.

Copyright Jigsaw Trading © 2024

Privacy Policy

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

Jigsaw Leaderboard

Note that the Jigsaw Leaderboard contains a mixture of SIM/Live Traders. For many traders, you can click by their name to see the trades along with the SIM/Live designation.

The following is a mandatory disclaimer for SIM Trading results: