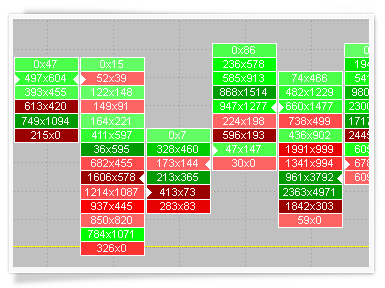

Best-in-Class Volume Analysis

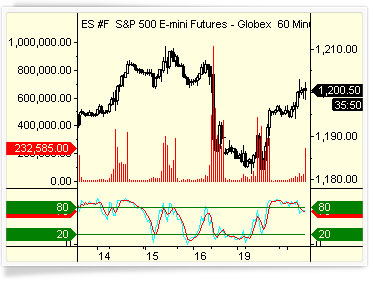

Importance of volume analysis cannot be underestimated. Paying attention to volume can be the crucial difference in understanding how the market will move. Volume Profile, Volume Delta, Cumulative Delta and pre-built Volume Indicators are designed to help you understand not only how much was bought, but at which prices activity was the highest, and whether there are more buyers than sellers.

Automated Trading

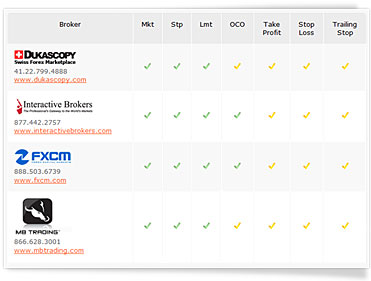

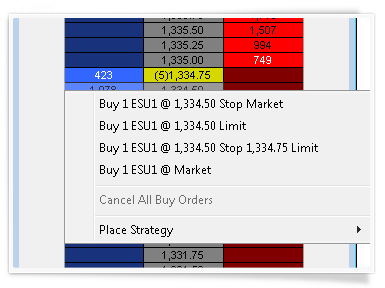

One-click Trading from Chart & DOM

MultiCharts features many tools to help you achieve your goals with Chart Trading, Trade Bar, Order and Position Tracker, Depth of Market, Automation of Entries and Exits, and Symbol Mapping.

Hundreds of Strategies & Indicators

All you need to do is right-click on the chart, and they are at your fingertips. Remember, you can always add more, or write your own in addition to existing ones.

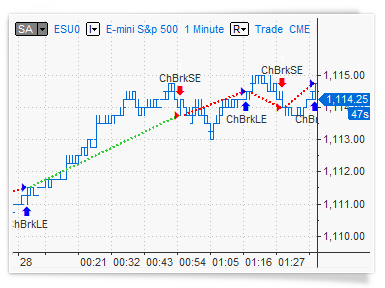

Replay Market Data

Market Data Replay allows you start playback at any point in the past, speed up or slow down replay speed, and even playback several instruments at once.

MultiCharts .NET including trading capabilities (chart, DOM, drag-and-drop strategies and fully automated), best charting in the industry, advanced strategy development capabilities in C# and Visual Basic, integration with Visual Studio, high-precision tick-by-tick strategy and portfolio backtesting, extremely fast optimization and more. Start the FREE 30 day trial now!

Copyright Jigsaw Trading © 2024

Privacy Policy

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

Jigsaw Leaderboard

Note that the Jigsaw Leaderboard contains a mixture of SIM/Live Traders. For many traders, you can click by their name to see the trades along with the SIM/Live designation.

The following is a mandatory disclaimer for SIM Trading results: