Lesson 7 – Depth & Sales

The comments made about the learning curve for the other products goes double for Depth & Sales. There is a lot of information on the screen. At first, you will simply not be able to absorb all of the information, just like most people can’t get in a car and drive the first time they try. You have two skills to develop, the first is to be able to read Depth & Sales and the second is to use the information to make trading decisions. Unless you are already someone that uses the DOM or advanced DOM products such as TTs XTrader, do not switch this on and try to trade off it. It will be unhealthy for your account. I regularly watch two or three Depth & Sales windows at a time. It was John Grady at No BS DayTrading that told me he watched three DOMs, at the time I was quite shocked. Two weeks later, I was doing the same thing. It’s simply a matter of practise, just like riding a bike…

Where are the buyers & where are the sellers?

The first thing to consider is where the buyers and sellers are. Internet forums are full of people saying that price went up because there were more buyers than sellers. This is nonsense, the markets are a mechanism for matching buyers and sellers. A trade only occurs when a buyer and a seller are willing to transact at a price. Every transaction has a buyer AND a seller. So – where are the buyers and sellers on Depth & Sales?

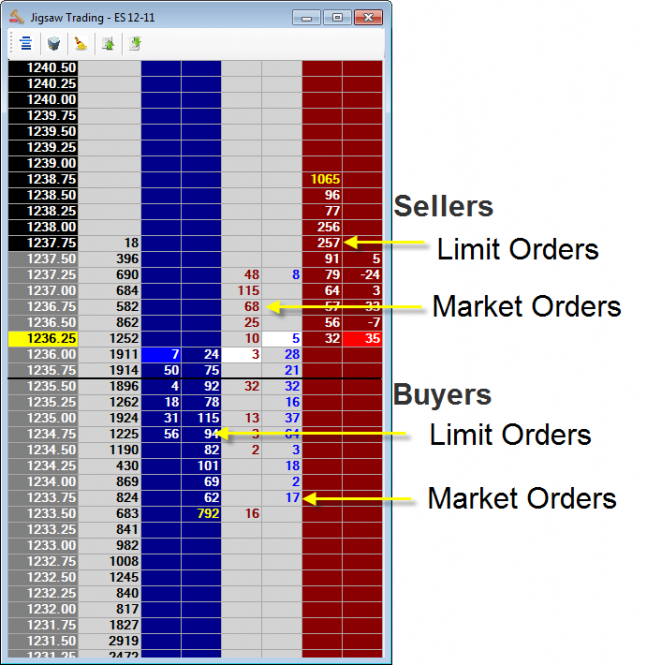

In the above image we can see we have two columns for buyers and two for sellers.

Limit Sell Orders – These are orders people place waiting for the market to come to them. If they want to sell, they put in a limit order above the current market price. If the price moves up to that level and people place market orders to buy, then these people will be sellers. Limit orders to buy (blue background) are called BIDS. Limit orders to sell (red background) are called OFFERS or ASKS.

Market Sell Orders – These are orders sent to the market to sell at the best price available. A market sell order will ‘hit’ this highest Buy Limit order (in this case 24 contracts at 1236.00). If the market sell order was more than 24 contracts, then 24 contracts would be filled at 1236 and the remaining at the price(s) lower down.

Limit orders show an intent to trade at a price. You can see these ahead of time, long before they are traded. Market orders you only see when someone actually submits the order and a trade occurs. With Depth and Sales, we are showing the limit orders AND the market orders that fill against them. Most of the time there is a discrepancy between what was on the limit order and what actually traded. Sometimes a lot more trade at the level than was shown because people add more limit orders at that price. This is known as an iceberg order. Other times, a lot fewer contracts trade because people pulled the limit orders.

This pulling/adding limit orders is not just going on at the current price, it’s going on at all prices. The DOM is often manipulated to look strong to attract buyers and to look weak to attracts sellers. In some ways, it’s a bit like a game of poker. Some people will say that “The DOM is useless because it is manipulated”. In fact, the reverse is true. The fact that it is manipulated is what makes it useful. Over time you will begin to recognise when someone is trying to build a position, when somebody is in a bad position and needs to get out, when a level is being defended, when the market is being made to look artificially weak or strong and when two large players take each other on in a ‘battle’ (Time to stand aside).

Volume Profile

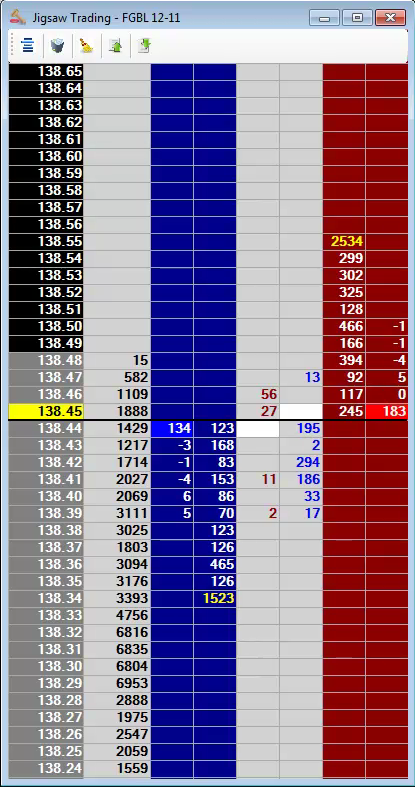

The volume profile shows how many contracts have traded in the current session.

In this image, we can see that between 138.29 and 138.32 we hade more than 6800 contracts trade at each level. We can see that 138.28 has seen only 2888 contracts traded compared to138.29 that has 6953 traded. This makes that level of 138.29 a key support level. The chart for this day would clearly show the consolidation that occurred between 138.29 and 138.32. If price came down to 138.29 again, it would be wise to start looking for signs of a reversal back upwards. Some traders will exclusively use the Volume Profile in place of a chart. My own opinion of this is that the volume profile is less helpful in markets that put in a lot of intra day swings such as Crude Oil. For markets such at the US treasuries, the Volume Profile is at least as useful (if not more useful) than an intra day chart.

DOM Training Video

The video below starts off from the point at which the image above was taken. If we look at the image above we can see

- Relatively large offers. 394 contracts offered at 138.48, 466 contacts offered at 138.50

- High of the day is 138.48 and only 15 contracts traded there, which is a sign that traders were not willing to buy that price. The reversal from the high did not occur because a large offer absorbed buying, there was no buying.

- We can see that on the way up from 138.39, we had 17,33,186, 294, 2, 195 contracts to tick up through the offers.

- The profile shows a lot of contracts traded between 138.33 and 138.29 and to a lesser extent between 138.42 and 138.34.

Note that this market was in a narrow range. That’s good for demo purposes as the reversals occur frequently. Sometimes a reversal off the high will lead to a move down of 10 ticks and sometimes it’ll lead to a move to the low of the day. If you are looking to get into day position trades, these methods are just as relevant to getting in at the best time possible.

This video is silent. Play it, pause it, replay it and get to understand what is happening according to the time line description below. Feel free to download it to your PC if that helps too.

|

Time Line

|

Action

|

|

00:00-00:22

|

264 contracts hit the offer at 138.45 and the inside offer ticks up to 138.46. There is a long pause during which time no buy or sell market orders go through. The large offers above at 138,48 and 138.50 seem to have buyers reluctant to buy at these prices. Eventually 105 contracts hit the bid at 138.45 and then another 104 to make a total of 209. It takes just another 3 contracts to hit the bid and then price ticks down. We had a total of 212 sell market contracts hitting the bid and only 4 buy market contracts hitting the offer. We have a combination of high of the day, large offers above & no buyers willing to buy 138.46. This is a good combination for a short term reversal.

|

|

00:23-00:40

|

We have 5 seconds where nothing much happens. Just 10 contracts hit the offer and 7 contracts hit the bid. Then we see someone take out the bids. By this I mean that someone hits the bid with a market order equal to the bid size. We see 105 contract hit 138.44 and it ticks down. Then we see 160 contracts bid there and BANG – somebody throws a market order of 160 at it. It ticks down again. 138.42 has 68 contracts thrown at it and it ticks down again. 138.41 has 61 contracts thrown at it and again it ticks down. Finally we see 29 at 138.40. There’s a few things to note about this type of action. We did see a couple of contracts trade at some of those bid levels but it ticked down each time on a single large trade. We didn’t see the volume hit the bid gradually, it was all in one shot. This is almost certainly one market player doing this. Based on this we can understand a couple of things. First of all, there’s somebody with deep pockets hitting the bid with market sell orders. Most likely he wants the market to follow through and he may have the resources to do that. What we also know is that if the price goes too much above 138.44, this seller may well have to bail out. He might be a swing trader and not care too much about adverse moves, he may also be hedging another position. The chances are that this is a large day trader that does not want to see this market make new highs.

|

|

00:40-1:22

|

When the market ticks down to bid 138.39/offer 138.40, we can see the offer size is 234. Someone hits this offer and the one above. We see 235 contracts traded at 138.40 and 23 at 138.41. This was probably one order for 250+ contracts that got filled at the two prices. The way price moves back upwards is very different from the down move. The orders that hit the offer come in gradually, it’s not a single player hitting the offers. This move up takes a lot longer than the move down and it also looks a lot less aggressive. Watch the down move & up move a few more times. See the difference?

|

|

1:15-2:38

|

We are back to the levels that got rejected before. We sit for a 11 seconds with the offer at 138.45 and then we tick up. 3 contracts hit the new offer of 138.46 and 54 hit the bid and we tick down. There seems to be a lack of buying at that level again. Is it because of those large offers overhead? Note that as we go down we see 72 contracts hit the bid at 138.39 and then 103 contracts hit the bid 138.38. When you see the quantity hitting the bid increase, your first thought might be “more selling” but remember that every seller has a buyer. The number we see there is “the number of contracts it took for price to tick down through the bid”. So the bidders brought 72 contracts at 138.39 but they were willing to buy 103 contracts at 138.38. Bidders are becoming more aggressive, look at the numbers above that it took to tick down before.37, 45, 12, 69, 27, 72, 103. It’s taking progressively more contracts to tick down.

|

|

2:39-3:24

|

At this point, we have ticked down past the point we ticked down to at the 40 seconds mark. We can see a large bid of 544 contracts at 138.35. Generally speaking the bid side is a lot thicker than the offer side. This could of course be fake. What we are looking for is a reaction. Do sellers start hitting it, do they shy away, do buyers start taking control?We are at a bid of 138.37, we know bidders have gotten slightly more aggressive. We have large bids below. We sit with the bid at 138.37 for 6 seconds and nobody wants to sell into that bid. We tick up and then back down again, watch the number of contracts bid and traded. At 2:48, we have 66 contracts bid and 63 contracts traded. At 2:58, we have 8 contracts bid and 172 traded. The number of contracts traded way exceeds those 66 bids that were there previously. At 3:04 we can see 61 contracts bid and 172 traded. It is quite clear that the bids are being refreshed. This is what is known as an iceberg order. Somebody is absorbing the selling but doesn’t want to show size on the bid. In the end we tick up with 94 contracts bid and 172 contracts traded.What did we have there? Just past the point of prior support, large bids below and an iceberg order absorbing the selling. In the end everybody saw this. Those sellers at 138.37 know they are on the wrong side and a move up is very likely.We come back to 138.37 one more time but only 15 contracts hit the bid there. Very few people are foolish enough to sell this right now. They were probably trading from the charts!

|

|

3:25- 5:08 |

Note the size that is hitting the bids here. We see 315 contracts hit the bid at 138.38. This means bidders were willing to buy 315 contracts. No-one hits the bid at 138.37 and we jump back up to 138.39. Here we see 505 contracts hit the bid at 138.39. It ticks down to 138.38 but nobody hits the bid there and it ticks back up. This is another great signal. We see large size hitting the bid but price can’t stay down. 505 contracts is the most we’ve seen at any level so far but there is no impact, no follow through. Price went down a tick but couldn’t stay down. Other people are watching the same thing. People that are short are getting nervous, people that are long are feeling comfortable (depending on where they went long) and people that are flat are considering a long entry. For a while we can see the market bounce up and down. Watch this a few times. Do you see how the moves down are slow and the moves up are fast pops? If you watch this a few times you will see a lot of different ‘tells’ that the down move is over and there are quite a few chances to buy 138.38

|

|

6:20-7:20

|

We are back up to the 138.45/138.46 ‘resistance’ level we moved down from before. We can see the offers have taken on a good amount of contracts on the way up and we can see large offers of 420 contracts at 138.48 and 468 contracts at 138.50. At 6:27, we can see 120 contracts have hit the bid at 138.44. We can see the ‘initial value’ of this bid was 23 contracts and it is now 15 contracts. We are looking at another iceberg order on the bid side. Now, we don’t know what that bidders intention is, he may be exiting a position, it may be a hedge. There may be no follow through or sellers might aggressively hit 138.44 and push through it. We have to deal with ‘probably’.At 6:35 we can see that 237 contracts have hit the bid at 138.44. It did tick down a couple of times but just for a fraction of a second each time. The large offers are still there above but this is no time to go short. We are close to the high and stop orders are just above the high. It could be that someone is holding the market here for a drive up through the high. If we are aggressive, we can try to go long here. If not, we will not go short as this time the behavior is very different from the last two times at this price level.At 6:44, we can see that 261 contracts ended up hitting 138.44. We can also see that the large offer at 138.48 has shrunk somewhat. It’s down to 360 from 420. We get up to the high and we see buyers take all of the offer at 138.48, a total of 332 contracts.

|

|

7:21-8:51

|

We have now gone up through the prior high by just 1 tick. We still have the large offer at 138.50 to contend with. At 8:13, we tick up to that level and somebody buys 191 contracts at 138.50 but price ticks DOWN on just 21 contracts. A few seconds later we tick up again and no contracts are traded. We have 267 contracts at the offer now. at 8:23 we tick back up to 138.50 and just 17 contracts trade and the offer stays firm at 249 contracts. The size up there is real and now nobody wants to hit it.At this point, we come down a few ticks. At 8:36 we are 138.47 bid, 138.48 offered. We have 52 contracts traded and 56 contracts offered. At 8:39, we have 202 contracts traded at the offer, another iceberg. We have just 60 contracts traded at the bid and price ticks down.We saw a rejection of the 138.50 level and now we see orders refreshing on the offer side and price ticking down on relatively low volume. We move up to 138.48 and the total value traded there is 353 contracts but price still can’t tick up. What do we think? Is price likely to move up or down in the short term?

|

|

10:35-

|

At the 10:35 point, we are back to the level that provided support earlier on. We can see that at 138.40 it took 204 contracts to tick down, we can see that at 138.39 it took 261 contracts to tick down. Bidders are becoming more aggressive. We can also see a large bid of 663 contracts at 138.35. We see 36 contracts hit the bid at 138.38 and 117 hit the offer of 138.39 and price ticks up. At 10:48 we tick back down to 138.39 with an above average bid of 165 contracts. We see just 16 contracts hit that bid.This short term reversal is not as clear as the others. Sometimes price just moves to a spot and reverses without a clear signal. You would either have to accept a late entry or be very aggressive to take a long at this point. Still, the level was marked out for us by the previous action.

|

At this point, you may well be overwhelmed by what you saw there. Perhaps you couldn’t see what was happening at all. When you look at this for the first time, almost 100% of your effort will be spent in trying to read the information on the screen. Over time the effort required to read this information becomes less and less until it becomes ‘automatic’ just like driving a car or riding a bike.

Bear in Mind

There’s a few things to bear in mind with this type of analysis. You will never know exactly whether the next tick will be up or down. The Depth & Sales tells a story and after a while you get used to reading those stories. Every story is not the same, this is not so much about ‘setups’ but more about reading the action.

Every market is not the same. Thick markets will have things in common, thin markets will have things in common but it is better to stick to one type of market or just one market whilst you learn this. Once you can read one market, it is not too difficult to switch to others.

Additional Trading Material

If you are interested in more advanced ‘setups’ there is an excellent and very cheap resource on the web for this. Don’t dive into this straight away, get some ‘screen time’ in first. To be honest, this was the first book I ever read on the topic and I didn’t get anywhere with it first time around. This is a book & video course that costs only $39.95 and has a 60 day money back guarantee.

The course is available here : http://www.nobsdaytrading.com/course.html

Please note that I do know John at No BS Day Trading, he was one of the reasons I got into this type of trading. I am not affiliated with Johns site, nor do I take any commissions or kickbacks from the sales on his book.

That’s the end of Lesson 7. Click Here to go back to the lesson plan.

Peter Davies.

Copyright Jigsaw Trading © 2024

Privacy Policy

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

Jigsaw Leaderboard

Note that the Jigsaw Leaderboard contains a mixture of SIM/Live Traders. For many traders, you can click by their name to see the trades along with the SIM/Live designation.

The following is a mandatory disclaimer for SIM Trading results: